Natural gas, unlike crude oil, is not an international market. The US, for example, only imports 3% of its natural gas consumption while importing 43% of its oil. As a result, markets around the world have developed much differently. The North American natural gas market is a completely separate entity that prices natural gas according to supply and demand at different locations. Asia and especially Europe, on the other hand, price natural gas by linking it to the price of oil.

Recently, oil and natural gas have decoupled from their traditional relationship. As oil has risen 70% this year, natural gas prices have fallen 22%. Since in Europe, prices are tied to oil, buyers of natural gas have paid above market price. The higher price of natural gas affects manufacturers and consumers as the price of electricity rises.

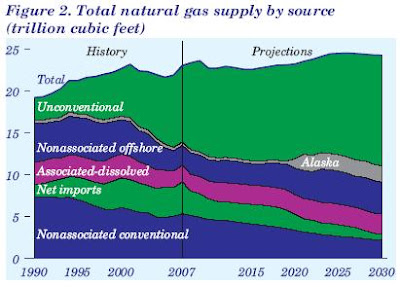

The price of natural gas is likely to remain low. As I wrote previously, the price of natural gas will depend on unconventional production. The drilling for natural gas decreased 58% from September 08 to September 09. The EIA's Energy Outlook from March '09 predicts unconventional production to increase dramatically in the future, keeping prices low.

It seems low prices are moving Europe's natural gas markets in the right direction. A draft of the World Energy Outlook 2009 (obtained by the FT) says "The prospect of a large glut in gas supplies persisting to at least the middle of the 2010s could have a profound impact on gas-pricing mechanisms." But, it also notes these changes "will be inevitably slow."

The biggest factor in this process is the undue influence big suppliers have in the European market. Big, state-owned producers in Russia and Algeria have an interest in maintaining the oil-gas link as it keeps gas prices lower. It will be interesting to follow the geopolitical aspects of these market reforms.

Long-term lower natural gas markets also imply increased use of natural gas for petroleum consumption. In 2007, only 6.5% of US petroleum use went to power generation. Converting this usage to natural gas will be "gradual" and would have only a "modest impact." On the industrial side, most petroleum consumption is unsuitable for substitution. The greatest potential is in the transportation sector, which matches up fairly well against oil.

The sticking point here is infrastructure. In 2008, there were only 778 natural gas service stations in the US. Building or converting 100,000+ service stations would likely make conversion uneconomical. Considering the difficulties of converting petroleum use, lower natural gas prices will likely have a limited effect on oil consumption, though they may spur market reform in Europe.